MLB Franchise Values Update Based on 2019 Forbes Report

By Martin J. Greenberg & Michael R. Gavin

I. Introduction

“Baseball is more lucrative than it has ever been[.]”[1] With increasing media rights revenue and higher profits, Major League Baseball (MLB or League) franchise (Club) values soared to new heights in 2019.[2] Ever since the 2012 purchase of the Los Angeles Dodgers by Guggenheim Baseball Management for a reported $2 billion, MLB franchise values have been increasing exponentially.[3] After the Dodgers purchase, each Club value increased by approximately 35 percent in 2013 according to Forbes, and the trend of increasing values continued.[4] For instance, in the 2014 Forbes report, the average value for an MLB franchise was $811 million.[5] One year later (2015), those figures skyrocketed to an average franchise value of $1.2 billion per Forbes.[6] Following three more years of increasing values, the average Club is now worth $1.78 billion according to the most recent, 2019 annual Forbes report on MLB franchise values.[7]

In our inaugural article on this subject in 2017, Sport$Biz predicted that MLB franchise values would continue to increase.[8] The article discussed in detail fourteen factors that were responsible for the rapid franchise value increases, which included: (1) the leadership and vision of former Commissioner Bud Selig; (2) national and local television contracts; (3) Major League Baseball Advanced Media (MLBAM); (4) MLB’s Revenue Sharing Program; and (5) the creation of new state-of-the-art facilities among others.[9] That prediction has remained correct. As mentioned earlier, MLB franchise values have continued to increase over the last few years, with the average team being worth $1.78 billion in 2019. This represents a 119.5 percent increase in value since 2014, and an 8.2 percent increase from last year, 2018 ($1.645 billion).[10] Also, over the last twenty-two years, Forbes states that “the average [Club] value has increased at an 11 [percent] compound annual rate of growth. Over the same span NBA and NFL team values have increased 13 [percent] and 12 [percent], respectively.”[11] Additionally, in the 2019 Forbes report, MLB achieved a major milestone with each team now being worth at least $1 billion.[12] The Tampa Bay Rays, who last year had a franchise value of $900 million, became the final team to earn a $1 billion or more franchise valuation from Forbes.[13]

II. MLB Clubs & League Financial Performance Snapshot

In terms of Club financial performance, according to the 2019 Forbes report, the average revenue per Club was $330 million, up $15 million from last year (or 4.8 percent).[14] Also, the average operating income per Club increased from $29 million in 2017 to $40 million in 2018, representing a 37.9 percent increase.[15] Despite the increase in Club revenue and operating income, the Forbes report shows that three Clubs experienced an operating loss (OL) in 2018: the Miami Marlins ($22 million OL), the Toronto Blue Jays ($16 million OL), and the Baltimore Orioles ($6.5 million OL).[16] Player costs, however, remained the same from the prior year despite the 2018 MLB offseason producing the most lucrative contract signings in the sport’s history (Mike Trout, Los Angeles Angels, 12-years, $430 million; Bryce Harper, Philadelphia Phillies, 13-years, $330 million; Manny Machado, San Diego Padres, 10-years, $300 million).[17] Forbes states that analytics and the Basic Agreement’s modified competitive balance tax and international signing bonuses are partly responsible for the lack of increase player spending despite increases in revenue and operating income.[18]

As for MLB as a whole, the League generated $10.3 billion in revenue during 2018, where most of the revenues stemmed from their central revenue (shared national television money, $2.76 billion) and local revenue (ballpark and regional sports network money, $7.29 billion).[19] MLB has already positioned itself to earn more revenue in the future. During the 2018 offseason, MLB reached a three-year digital rights deal with DAZN (“da zone”) for a reported $300 million.[20] In this partnership, DAZN will broadcast a live show each weeknight, and provide on-demand MLB content along with “live weekend wrap shows available to DAZN subscribers.”[21] Also during the 2018 offseason, MLB and Fox Sports agreed to a seven-year extension of their current media rights partnership.[22] The extension will begin in 2022 and will last through 2028, in which Fox Sports will pay MLB $5.1 billion ($728.6 million annually) during that time.[23] MLB’s current deal with Fox Sports began in 2014, where Fox Sports pays MLB $525 million annually through 2021 (eight years, $4.2 billion total).[24] With the extension, MLB’s annual national television revenues from Fox Sports will increase 38.8 percent ($728.6 million compared to $525 million). As a result, each Club will approximately receive an additional $7 million ($203.6 million for 30 Clubs) annually once the Fox Sports extension begins in 2022. Each Club is currently receiving $25 million annually from all of MLB’s national television deals.[25] With the additional $7 million that will begin in 2022 from the Fox Sports extension, each Club’s share of national television revenue will increase 28 percent without considering possible extensions with TBS and ESPN.[26] Finally, MLB is expected to earn additional revenue from YouTube through an agreement where YouTube will have the exclusive right to stream thirteen games during the second half of the 2019 season.[27] Terms were not disclosed; however, MLB and YouTube had a similar agreement in 2018, which gave YouTube exclusive streaming rights for 25 games for around $30-35 million per a report.[28]

III. Emergence of Sports Betting Integrity Fees as a Potential New Revenue Source

Besides their traditional revenue streams, such as national and local television deals, sponsorship agreements, and ticket sales among others, MLB and its Clubs are trying to enter into unchartered territory to earn additional revenue: sports betting integrity fees. Sports betting integrity fees “are basically taxes on legal sports betting.”[29] This was made possible through a recent decision made by the Supreme Court of the United States (SCOTUS). On May 14, 2018, SCOTUS held in Murphy v. NCAA that the Professional and Amateur Sports Protection Act of 1992 (PASPA) was unconstitutional as it violated the Tenth Amendment to the United States Constitution, specifically the anti-commandeering doctrine.[30] The anti-commandeering doctrine essentially states that the federal government cannot compel states to enforce federal law.[31] Under PASPA, states were prohibited from sanctioning sports gambling, in which they could not “‘sponsor, operate, advertise, promote, license, or authorize by law or compact . . . [a] betting, gambling, or wagering scheme based . . . on’ competitive sporting events.”[32] Nevada, Oregon, Delaware, and Montana, however, were granted exemptions under PASPA.[33] New Jersey, who was previously against sports gambling, now wanted to authorize sports gambling and argued that PASPA was unconstitutional “because it regulates a State’s exercise of its lawmaking power by prohibiting it from modifying or repealing its laws prohibiting sports gambling.”[34] SCOTUS agreed with New Jersey that PASPA violated the Constitution under the anti-commandeering doctrine because federal legislation that prohibits a state from authorizing sports gambling legislation is compelling the state to follow federal law.[35]

Several professional sports leagues are seeking to implement sports betting integrity fees.[36] Through these fees, leagues are “look[ing] to find a way to profit from the proliferation of sports betting in the US. The fee would transfer money from sportsbooks to sports governing bodies themselves.”[37] With states now possessing the ability to regulate sports betting in their jurisdictions, the professional sports leagues are experiencing difficulties with getting the states to implement sports betting integrity fees into their sports betting laws, where the fees would take away state revenue.[38] Sports betting integrity fees function by taxing handle, the total amount wagered by bettors, at a certain rate.[39] Revenue, in this case, “is how much sportsbooks hold from the total amount wagered. Historically, this number comes in at about five percent of handle for sportsbook operators.”[40] For example, considering a 5 percent handle, a 1 percent integrity fee computes to 20 percent of the revenue that would be earned by a professional sports league.[41]

Several professional sports leagues are seeking to implement sports betting integrity fees.[36] Through these fees, leagues are “look[ing] to find a way to profit from the proliferation of sports betting in the US. The fee would transfer money from sportsbooks to sports governing bodies themselves.”[37] With states now possessing the ability to regulate sports betting in their jurisdictions, the professional sports leagues are experiencing difficulties with getting the states to implement sports betting integrity fees into their sports betting laws, where the fees would take away state revenue.[38] Sports betting integrity fees function by taxing handle, the total amount wagered by bettors, at a certain rate.[39] Revenue, in this case, “is how much sportsbooks hold from the total amount wagered. Historically, this number comes in at about five percent of handle for sportsbook operators.”[40] For example, considering a 5 percent handle, a 1 percent integrity fee computes to 20 percent of the revenue that would be earned by a professional sports league.[41]

Currently, MLB is asking for an integrity fee of 0.25 percent, which would result in 5 percent of the betting revenue going to MLB.[42] Based on a recent joint study commissioned by MLB and the National Basketball Association (NBA), the approximate twenty states that are considering sports betting legislation could earn gaming revenues between $6.5 billion and $9.5 billion.[43] According to the commissioned report, if the states allow MLB to become involved as a partner, where the League could pledge to the states and gambling operators “more tie-ins with local teams, promotion via MLB’s website and social media, and access to the league’s official data,” the revenues will be on the higher end of this range.[44] Additionally, MLB “could help advance effective regulation, reasonable taxation and mobile betting. Mobile alone could be worth triple the proposed fee.”[45] This commissioned report assumed an integrity fee of 0.25 percent and if MLB, for example, evenly splits the league portions of gaming revenues with the NBA, the League could earn gaming revenues between $162.5 million and $237.5 million annually.[46] If these revenues are shared evenly among the Clubs, each Club could earn between $5.4 million to $7.9 million annually. Again, these are revenue figures based on approximately twenty states that have considered sports betting legislation, and the annual revenue figures could multiply once more states consider sports betting legislation or if the federal government enacts sports betting legislation. With that said, if sports betting integrity fees are implemented, MLB Clubs will be able to access a new multi-million-dollar revenue stream and further increase their respective values.

Currently, MLB is asking for an integrity fee of 0.25 percent, which would result in 5 percent of the betting revenue going to MLB.[42] Based on a recent joint study commissioned by MLB and the National Basketball Association (NBA), the approximate twenty states that are considering sports betting legislation could earn gaming revenues between $6.5 billion and $9.5 billion.[43] According to the commissioned report, if the states allow MLB to become involved as a partner, where the League could pledge to the states and gambling operators “more tie-ins with local teams, promotion via MLB’s website and social media, and access to the league’s official data,” the revenues will be on the higher end of this range.[44] Additionally, MLB “could help advance effective regulation, reasonable taxation and mobile betting. Mobile alone could be worth triple the proposed fee.”[45] This commissioned report assumed an integrity fee of 0.25 percent and if MLB, for example, evenly splits the league portions of gaming revenues with the NBA, the League could earn gaming revenues between $162.5 million and $237.5 million annually.[46] If these revenues are shared evenly among the Clubs, each Club could earn between $5.4 million to $7.9 million annually. Again, these are revenue figures based on approximately twenty states that have considered sports betting legislation, and the annual revenue figures could multiply once more states consider sports betting legislation or if the federal government enacts sports betting legislation. With that said, if sports betting integrity fees are implemented, MLB Clubs will be able to access a new multi-million-dollar revenue stream and further increase their respective values.

IV. 2019 MLB Franchise Values & the Current State of the Milwaukee Brewers

This is the twenty-second edition of the Forbes MLB franchise values report.[47] As mentioned in previous Sport$Biz articles, Forbes’ MLB franchise values “are enterprise values (equity plus net debt) that include the economics of the ballpark but exclude the value of real estate itself.”[48] Forbes’ MLB franchise values also exclude the equity values of Club-owned regional sports networks.[49] Additionally, Forbes excluded the one-time payment of $50 million that each Club received from the sale of an interest in BamTech to the Walt Disney Company (Disney).[50] Forbes’ MLB franchise values report does include ownership interests in MLBAM (100 percent), BamTech (15 percent), MLB Network (67 percent), and the league’s investment portfolio in each Club’s franchise value.[51] MLBAM, BamTech, and MLB Network account for at least $400 million in value for each MLB franchise.[52]

According to the 2019 Forbes report, the New York Yankees remained the most valuable MLB franchise at $4.6 billion, a 15 percent increase from last year ($4 billion).[53] Making up the Yankees’ $4.6 billion valuation consists of: (1) $632 million in revenue sharing proceeds; (2) $2.158 billion attributed to the Bronx/New York City and market; (3) $995 million due to the value of Yankee Stadium; and (4) an $815 million brand value.[54] In 2018, the Yankees earned $668 million in revenue and achieved an operating income of $29 million.[55] Recently, the Yankees and a group of investors, including Amazon and Sinclair Broadcasting Group, purchased the YES Network from Disney in March 2019 for a reported $3.47 billion.[56] This will allow the Yankees to expand their coverage through broadcasting with Sinclair and over-the-top (streaming) services with Amazon.[57] With MLB now giving direct-to-consumer control back to its Clubs, the Yankees could mold the YES Network into a national over-the-top network to compete with other national television networks.[58] Other benefits of the Yankees’ acquisition of the YES Network include a share of the highest monthly affiliate fee in MLB ($6.37) and an expected cash flow of $400 million from the network, which would be higher than any other regional sports network by hundreds of millions of dollars.[59] Just like last year, the Yankees have separated themselves from the pack based on franchise valuation, in which the Yankees are worth $1.3 billion more than the second most valuable team, the Los Angeles Dodgers ($3.3 billion).[60]

According to the 2019 Forbes report, the New York Yankees remained the most valuable MLB franchise at $4.6 billion, a 15 percent increase from last year ($4 billion).[53] Making up the Yankees’ $4.6 billion valuation consists of: (1) $632 million in revenue sharing proceeds; (2) $2.158 billion attributed to the Bronx/New York City and market; (3) $995 million due to the value of Yankee Stadium; and (4) an $815 million brand value.[54] In 2018, the Yankees earned $668 million in revenue and achieved an operating income of $29 million.[55] Recently, the Yankees and a group of investors, including Amazon and Sinclair Broadcasting Group, purchased the YES Network from Disney in March 2019 for a reported $3.47 billion.[56] This will allow the Yankees to expand their coverage through broadcasting with Sinclair and over-the-top (streaming) services with Amazon.[57] With MLB now giving direct-to-consumer control back to its Clubs, the Yankees could mold the YES Network into a national over-the-top network to compete with other national television networks.[58] Other benefits of the Yankees’ acquisition of the YES Network include a share of the highest monthly affiliate fee in MLB ($6.37) and an expected cash flow of $400 million from the network, which would be higher than any other regional sports network by hundreds of millions of dollars.[59] Just like last year, the Yankees have separated themselves from the pack based on franchise valuation, in which the Yankees are worth $1.3 billion more than the second most valuable team, the Los Angeles Dodgers ($3.3 billion).[60]

2019 Forbes MLB Franchise Values Rankings[61]

| Rank | Club | Value |

| 1 | New York Yankees | $4.6 billion |

| 2 | Los Angeles Dodgers | $3.3 billion |

| 3 | Boston Red Sox | $3.2 billion |

| 4 | Chicago Cubs | $3.1 billion |

| 5 | San Francisco Giants | $3.0 billion |

| 6 | New York Mets | $2.3 billion |

| 7 | St. Louis Cardinals | $2.1 billion |

| 8 | Los Angeles Angels | $1.9 billion |

| 9 | Philadelphia Phillies | $1.85 billion |

| 10 | Houston Astros | $1.775 billion |

| 11 | Washington Nationals | $1.75 billion |

| 12 | Atlanta Braves | $1.7 billion |

| 13 | Texas Rangers | $1.65 billion |

| 14 | Chicago White Sox | $1.6 billion |

| 15 | Seattle Mariners | $1.575 billion |

| 16 | Toronto Blue Jays | $1.5 billion |

| 17 | San Diego Padres | $1.35 billion |

| 18 | Arizona Diamondbacks | $1.29 billion |

| 19 | Baltimore Orioles | $1.28 billion |

| 20 | Pittsburgh Pirates | $1.275 billion |

| 21 | Detroit Tigers | $1.25 billion |

| 22 | Colorado Rockies | $1.225 billion |

| 23 | Minnesota Twins | $1.2 billion |

| 24 | Milwaukee Brewers | $1.175 billion |

| 25 | Cleveland Indians | $1.15 billion |

| 26 | Oakland Athletics | $1.1 billion |

| 27 | Cincinnati Reds | $1.05 billion |

| 28 | Kansas City Royals | $1.025 billion |

| 29 | Tampa Bay Rays | $1.01 billion |

| 30 | Miami Marlins | $1.0 billion |

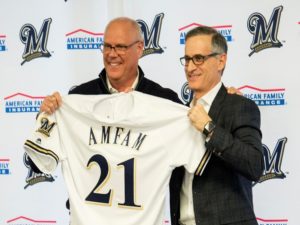

As for the hometown team, the Milwaukee Brewers earned a $1.175 billion valuation from Forbes’ 2019 report.[62] This represents a 14.1 percent increase in value from the prior year ($1.03 billion).[63] With the $1.175 billion valuation, the Brewers move up one spot from last year and become the 24th most valuable franchise according to the Forbes report.[64] The Brewers’ $1.175 billion valuation consists of: (1) $464 million from revenue sharing: (2) $366 million attributable to city of Milwaukee and its market size; (3) $239 million in value from Miller Park; and (4) a $106 million brand value.[65] Forbes reports that in 2018, the Brewers generated $288 million in revenue and had an operating income of $66 million, thereby resulting in an operating profit of 22.9 percent.[66] Other key 2018 financial figures for the Brewers from the Forbes report are $111 of revenue per fan, which is defined as “local revenues divided by metro population with populations in two-team markets divided in half[,]” and gate receipts of $82 million as a result of the 2.85 million Miller Park attendance in 2018.[67] The Brewers are already looking forward to revenue increases in the future from their new naming rights agreement with American Family Insurance, which takes effect in 2021 and will last fifteen years.[68] American Family Insurance will pay approximately $4 million per year in naming rights fees, which is about double the amount that MillerCoors currently pays annually for the naming rights of the ballpark, Miller Park.[69] As part of the naming rights agreement, American Family Insurance will also have the naming rights to the Brewers’ spring training complex, Maryvale Baseball Park, in Phoenix, Arizona.[70]

Along with their future increase in annual naming rights fees, the Brewers could leverage their recent success to increase ticket sales and their regional sports network annual rights fee. The Brewers had a memorable 2018 season by winning the National League Central Division Championship and advancing to the National League Championship Series against the Los Angeles Dodgers.[71] The Brewers, who were in a rebuilding mode as late as 2017, got ahead of the curve by making some key acquisitions, including the trade for Outfielder Christian Yelich, who won the National League’s Most Valuable Player Award, a Silver Slugger Award, and was named an All-Star for the 2018 season.[72] If the Club continues to build on their 2018 success, the Brewers could command a more lucrative contract from Fox Sports Wisconsin, the regional sports network for the Brewers.[73] The Brewers currently receive $20 million annually in network television rights fees from Fox Sports Wisconsin, which is one of the lowest annual rights fees in all of baseball.[74] The Brewers-Fox Sports Wisconsin television rights partnership expires after the 2019 season and with the Brewers’ current on-field success, there is a chance that the next regional sports network deal will be more lucrative for the Brewers, whose regular season television ratings increased 37 percent from the prior year.[75] Also, the successful on-field performance can lead to more ticket revenue for the Brewers as attendance increases. For example, the Brewers average attendance increased from 31,282 per game in 2017 to 35,196 per game in 2018, an increase of 12.5 percent.[76] Furthermore, gate receipts increased as well from 2017 ($66 million) to 2018 ($82 million), resulting in a 24.2 percent increase.[77]

Along with their future increase in annual naming rights fees, the Brewers could leverage their recent success to increase ticket sales and their regional sports network annual rights fee. The Brewers had a memorable 2018 season by winning the National League Central Division Championship and advancing to the National League Championship Series against the Los Angeles Dodgers.[71] The Brewers, who were in a rebuilding mode as late as 2017, got ahead of the curve by making some key acquisitions, including the trade for Outfielder Christian Yelich, who won the National League’s Most Valuable Player Award, a Silver Slugger Award, and was named an All-Star for the 2018 season.[72] If the Club continues to build on their 2018 success, the Brewers could command a more lucrative contract from Fox Sports Wisconsin, the regional sports network for the Brewers.[73] The Brewers currently receive $20 million annually in network television rights fees from Fox Sports Wisconsin, which is one of the lowest annual rights fees in all of baseball.[74] The Brewers-Fox Sports Wisconsin television rights partnership expires after the 2019 season and with the Brewers’ current on-field success, there is a chance that the next regional sports network deal will be more lucrative for the Brewers, whose regular season television ratings increased 37 percent from the prior year.[75] Also, the successful on-field performance can lead to more ticket revenue for the Brewers as attendance increases. For example, the Brewers average attendance increased from 31,282 per game in 2017 to 35,196 per game in 2018, an increase of 12.5 percent.[76] Furthermore, gate receipts increased as well from 2017 ($66 million) to 2018 ($82 million), resulting in a 24.2 percent increase.[77]

Despite being the 24th most valuable MLB franchise, the Milwaukee Brewers have proven to be a sound financial investment for owner Mark Attanasio. Attanasio purchased the Club in 2005 for $223 million.[78] Currently, Attanasio has earned a 426.9 percent return on investment from his Brewers acquisition.[79] With the new, more lucrative stadium naming rights agreement with American Family Insurance set to begin in 2021, along with the successful on-field performance that could generate additional revenue by means of a more lucrative regional sports network contract and increased gate receipts, the Brewers continue to be a sound investment and should continue its encouraging trend of franchise valuation increases.

V. Conclusion

MLB Clubs continue to be solid financial investments for their owners as they are consistently experiencing increases in value. These valuation increases are driven by rising revenues and higher operating income. Also, MLB and its Clubs are jumping on new, lucrative media opportunities through on-demand and streaming services, which has been an initiative of Commissioner Rob Manfred in order to appeal to the modern day, younger consumers.[80] Additionally, MLB is executing more lucrative, national television contract extensions for their Clubs and are trying to tap into new revenue streams through potential sports betting integrity fees. MLB has historically opposed gambling due to integrity of the game concerns but are now embracing controlled sports gambling in light of PASPA being struck down by SCOTUS.[81] Furthermore, MLB created a new sports gambling related revenue stream by striking a four-year, $80 million (total) sponsorship agreement with MGM Resorts in November 2018, where the deal “identifies MGM as an ‘MLB-authorized gaming operator,’ grants the company the right to use an official statistics feed[,] and provides exclusive access to what the [L]eague called ‘enhanced statistics.’”[82]

Most recently, a July 2019 article from the Sports Business Journal reported that MLB is starting to actively pursue implementing jersey patches on Club uniforms.[83] MLB views the jersey patch as an attractive new revenue stream to pursue as they have seen how much revenue NBA teams have generated from jersey advertising.[84] The jersey patches in the NBA, which are 2.5-by-2.5-inches, generate anywhere from $5 million to $20 million in annual revenue for each NBA team, with the average jersey patch deal being worth $7 million annually.[85] Van Wagner Sports & Entertainment’s (VWS&E) Kyle Folts, Vice President of Insights, told the Sports Business Journal that VWS&E estimates that the average jersey patch deal for a MLB Club could be worth $6 million to $8 million annually, with some of the more sacred Clubs like the Yankees commanding more lucrative deals.[86] The Major League Baseball Players Association (MLBPA), however, will have to approve the jersey patches as part of the next Basic Agreement, in which the current Basic Agreement expires after the 2021 season.[87] This is a significant development for future Club financial performance, which will be monitored over the next few years as more information becomes available.

Overall, MLB Clubs continue to be a lucrative business venture for their owners. Considering both current and future revenue generation mechanisms, owners will be able to command a larger return if they decide to sell their Club since MLB and its Clubs are consistently finding ways to generate more revenue, which could lead to higher net profits. With MLB’s commitment to both generate new media rights revenue and increase current national television revenue, expand into areas that were previously unattainable based on prior League business philosophy (sports gambling), and use analytics to drive business decisions such as spending among other financial strategies, we at Sport$Biz look forward to continue seeing MLB franchise values increase not only next year but into the foreseeable future as well.

Michael R. Gavin is a Wisconsin-licensed attorney. In May 2017, Gavin earned his Juris Doctor from Marquette University Law School (Milwaukee, WI) along with a Sports Law Certificate from the National Sports Law Institute through Marquette. While a student, he served as Executive Editor for the Marquette Sports Law Review (Volume 27), and was a member of both the Sports Law Society and Business Law Society. Also, Gavin won Marquette’s annual Sports Law Intramural Negotiation Competition in 2016 as a second-year law student, and followed that up with a second place performance at the 2017 National Baseball Arbitration Competition held in New Orleans, Louisiana, as a third-year law student representing Marquette. Prior to Marquette, he earned his bachelor of arts in Accounting from Washington & Jefferson College (Washington, PA), with a concentration in Entrepreneurial Studies. Currently, Gavin works in the Tax Department for a major Financial Services corporation in Pittsburgh, PA, and is pursuing a Certified Public Accountant license.

[1] Mike Ozanian & Kurt Badenhausen, Baseball Team Values 2019: Yankees Lead League at $4.6 Billion, Forbes (Apr. 10, 2019), https://www.forbes.com/sites/mikeozanian/2019/04/10/baseball-team-values-2019-yankees-lead-league-at-46-billion/#fa80a4169b2e.

[2] See id.

[3] Martin J. Greenberg & Michael R. Gavin, Post-Script: Blast Off! Why Are MLB Franchise Values Skyrocketing at an Astounding Rate?– MLB Franchise Values Update Based on 2018 Forbes Report, Greenberg L. Off.: Sport$Biz (June 1, 2018), https://greenberglawoffice.com/mlb-franchise-values-update-2018/.

[4] Id.

[5] Martin J. Greenberg & Michael R. Gavin, Blast Off! Why Are MLB Franchise Values Skyrocketing at an Astounding Rate?, Greenberg L. Off.: Sport$Biz (Feb. 1, 2017), https://greenberglawoffice.com/mlb-franchise-values-skyrocketing/.

[6] Id.

[7] Ozanian & Badenhausen, supra note 1; The Business of Baseball, Forbes, https://www.forbes.com/mlb-valuations/list/#tab:overall (last visited June 9, 2019).

[8] Greenberg & Gavin, supra note 5.

[9] Id.

[10] Greenberg & Gavin, supra note 3.

[11] Ozanian & Badenhausen, supra note 1.

[12] The Business of Baseball, supra note 7.

[13] See id.; Greenberg & Gavin, supra note 3.

[14] Ozanian & Badenhausen, supra note 1; Greenberg & Gavin, supra note 3.

[15] Ozanian & Badenhausen, supra note 1; Greenberg & Gavin, supra note 3.

[16] The Business of Baseball, supra note 7.

[17] Ozanian & Badenhausen, supra note 1; Matt Snyder, Mike Trout Reaches Record-breaking 12-year, $430 Million Extension with Angels, CBSSports.com (Mar. 21, 2019), https://www.cbssports.com/mlb/news/mike-trout-finalizing-12-year-430-million-extension-with-angels-report-says/; Emily Caron, Manny Machado Contract: Padres Deal Worth $300 Million, SI.com (Feb. 19, 2019), https://www.si.com/mlb/2019/01/19/manny-machado-padres-10-year-300-million-deal-biggest-free-agent-contract-ever.

[18] Ozanian & Badenhausen, supra note 1.

[19] Id.; Maury Brown, MLB Sees Record Revenues of $10.3 Billion for 2018, Forbes (Jan. 7, 2019), https://www.forbes.com/sites/maurybrown/2019/01/07/mlb-sees-record-revenues-of-10-3-billion-for-2018/#7a892fd55bea.

[20] Mike Snider, MLB Highlights Will Hit Streaming Service DAZN in 2019 Season, USA Today (Nov. 15, 2018), https://www.usatoday.com/story/tech/talkingtech/2018/11/15/mlb-highlights-hit-streaming-service-dazn-2019-season/2012340002/; R. Thomas Umstead, DAZN Steps to the Plate with MLB Digital Rights Deal, Multichannel (Nov. 15, 2018), https://www.multichannel.com/blog/dazn-steps-to-the-plate-with-mlb-digital-rights-deal.

[21] DAZN Reaches Three Year Rights Deal with MLB; Will Produce Live Weeknight Show, Sports Video Group (Nov. 15, 2018), https://www.sportsvideo.org/2018/11/15/dazn-reaches-three-year-rights-deal-with-mlb-will-produce-live-weeknight-show/.

[22] John Ourand & Eric Fisher, MLB Signs Seven-year Extension with Fox Worth $5.1B, Sports Bus. Daily (Nov. 15, 2018), https://www.sportsbusinessdaily.com/Daily/Issues/2018/11/15/Media/MLB-Fox.aspx.

[23] Id.

[24] James Wagner, M.L.B. Extends TV Deal with Fox Sports through 2028, N.Y. Times (Nov. 15, 2018), https://www.nytimes.com/2018/11/15/sports/mlb-fox-tv-deal.html; Greenberg & Gavin, supra note 5.

[25] Greenberg & Gavin, supra note 5.

[26] See Ourand & Fisher, supra note 22.

[27] Chris Welch, YouTube Will Exclusively Stream 13 MLB Games This Season, Verge (Apr. 30, 2019), https://www.theverge.com/2019/4/30/18524132/youtube-mlb-baseball-games-exclusive-streaming-13-deal-sports.

[28] Daniel Frankel, YouTube Signs onto 13-game MLB Package, Multichannel (Apr. 30, 2019), https://www.multichannel.com/news/youtube-signs-onto-to-13-game-exclusive-mlb-package; Troy Dreier, MLB, YouTube TV Expand Mutual Promotion Agreement for Two Seasons, Streaming Media (Mar. 9, 2018), https://www.streamingmedia.com/Articles/ReadArticle.aspx?ArticleID=123747.

[29] Sports Betting Integrity Fee – What Is an Integrity Fee?, Legal Sports Rep. (May 15, 2018), https://www.legalsportsreport.com/integrity-fee/.

[30] Murphy v. NCAA, 138 S. Ct. 1461, 1475-81 (2018).

[31] Id. at 1475-78.

[32] Id. at 1470.

[33] Professional and Amateur Sports Protection Act, 28 U.S.C. § 3704(a)(2) (1992). Nevada, Oregon, Delaware, and Montana received exemptions because those states had sports betting laws in effect before PASPA was signed into law. See id.; see also Ryan Rodenberg, Sports Betting Myth Busters: Only Four States Are Exempt from US Ban, Legal Sports Rep. (Jan. 8, 2018), https://www.legalsportsreport.com/17193/sports-betting-myth-busters-paspa-exemptions/.

[34] Murphy, 138 S. Ct. at 1471.

[35] Id. at 1478.

[36] See Sports Betting Integrity Fee – What Is an Integrity Fee?, supra note 29.

[37] Id.

[38] Id.

[39] Id.

[40] Id.

[41] Id.

[42] See id.; see also Eben Novy-Williams, Giving MLB, NBA Cut of Sports Bets Could Boost Revenue: Study, Bloomberg (Apr. 3, 2019), https://www.bloomberg.com/news/articles/2019-04-03/controversial-sports-betting-fee-would-boost-revenue-study-says. With a one percent integrity fee resulting in twenty percent of the revenue going to a professional sports league, a 0.25 percent integrity fee would proportionally generate five percent of the betting revenue for MLB.

[43] Novy-Williams, supra note 42.

[44] Id.

[45] Id.

[46] See id.

[47] Ozanian & Badenhausen, supra note 1.

[48] Id.

[49] Id.

[50] Id.

[51] Id.

[52] Id.

[53] Id.; Greenberg & Gavin, supra note 3; New York Yankees on the Forbes MLB Team Valuations List, Forbes, https://www.forbes.com/teams/new-york-yankees/#5ff1ecdd4e6e (last visited June 15, 2019).

[54] New York Yankees on the Forbes MLB Team Valuations List, supra note 53.

[55] Id.

[56] Mike Ozanian, New York Yankees Buy Back YES Network for $3.47 Billion, Forbes (Mar. 8, 2019), https://www.forbes.com/sites/mikeozanian/2019/03/08/new-york-yankees-buy-back-yes-network-for-3-47-billion/#2c9634ec483c.

[57] Id.

[58] Id.

[59] Id.

[60] The Business of Baseball, supra note 7.

[61] Id.

[62] Id.

[63] Milwaukee Brewers on the Forbes MLB Team Valuations List, Forbes, https://www.forbes.com/teams/milwaukee-brewers/#4d47c3e641fe (last visited June 15, 2019); Greenberg & Gavin, supra note 3.

[64] Milwaukee Brewers on the Forbes MLB Team Valuations List, supra note 63; Greenberg & Gavin, supra note 3.

[65] Milwaukee Brewers on the Forbes MLB Team Valuations List, supra note 63.

[66] Id.

[67] Id.; Jay Sorgi, Brewers Made $66 Million Profit in 2018; Team Makes Second-most per Fan on Locally-Sourced Revenue, WTMJ (Apr. 10, 2019), http://www.wtmj.com/sports/baseball/milwaukee-brewers/brewers-made-66-million-in-2018-team-makes-second-most-per-fan-in-all-of-major-league-baseball/1067753279.

[68] Milwaukee Brewers on the Forbes MLB Team Valuations List, supra note 63.

[69] Id.

[70] Id.; Greenberg & Gavin, supra note 3.

[71] Nick Williams, Brewers’ Value Rises 14% to $1.175 Billion Following Historic Season, Forbes Says, Forbes (Apr. 11, 2019), https://www.bizjournals.com/milwaukee/news/2019/04/11/brewers-value-rises-14-following-historic-season.html; 2018 NLCS – Los Angeles Dodgers over Milwaukee Brewers (4-3), Baseball-Reference, https://www.baseball-reference.com/postseason/2018_NLCS.shtml (last visited June 15, 2019).

[72] Christian Yelich Stats, Baseball-Reference, https://www.baseball-reference.com/players/y/yelicch01.shtml (last visited June 15, 2019).

[73] Greenberg & Gavin, supra note 5.

[74] Id.

[75] Williams, supra note 71.

[76] Id.

[77] Milwaukee Brewers on the Forbes MLB Team Valuations List, supra note 63; Milwaukee Brewers Gate Receipts (Ticketing) 2009–2017, statista, https://www.statista.com/statistics/294178/milwaukee-brewers-gate-receipts/ (last visited June 16, 2019).

[78] Milwaukee Brewers on the Forbes MLB Team Valuations List, supra note 63.

[79] Return on investment is computed as: (Current value of investment minus cost of investment)/cost of investment. Return on Investment (ROI), Investopedia, https://www.investopedia.com/terms/r/returnoninvestment.asp (last visited June 18, 2019). Based on Forbes’ current valuation for the Brewers, Attanasio’s current return on investment is 426.9 percent (($1.175 billion – $223 million)/$223 million).

[80] Greenberg & Gavin, supra note 3.

[81] See Ronald Blum, MLB Strikes Deal with MGM as Legal Gambling Expands in US, Associated Press (Nov. 27, 2018), https://www.apnews.com/4ace6792c6f34967bb8e8bcdb2d2416f.

[82] Bill Shaikin, MLB Becomes Third Major Sports League to Form Partnership with MGM, L.A. Times (Nov. 27, 2018), https://www.latimes.com/sports/mlb/la-sp-mlb-mgm-partnership-20181127-story.html.

[83] Terry Lefton, Patches in Progress for MLB, Sports Bus. J. (July 15, 2019), https://www.sportsbusinessdaily.com/Journal/Issues/2019/07/15/Leagues-and-Governing-Bodies/MLB-patches.aspx.

[84] Id.

[85] Id.; Terry Lefton & John Lombardo, NBA: Big Payoff for a Little Patch, Sports Bus. J. (Feb. 25, 2019), https://www.sportsbusinessdaily.com/Journal/Issues/2019/02/25/Leagues-and-Governing-Bodies/NBA-patches.aspx.

[86] Lefton, supra note 83.

[87] Id.